Wealthy investors in the Gulf should move money out of public markets and into alternative assets in their home region, such as private equity, says Amrith Mukkamala of MEFIC Capital.

Wealthy investors in the Gulf should move money out of public markets and into alternative assets in their home region, such as private equity, says Amrith Mukkamala of MEFIC Capital.

Ultra-high-net-worth individuals and family offices in the Gulf Cooperation Council (GCC) historically had little home bias compared to the rest of the world. This is partly because regional equity and regional real estate were the only two avenues for this class of client and each segment had idiosyncratic risks.

The GCC equity markets lacked robust regulatory frameworks as compared to Bric (Brazil, Russia, India and China) peers, while the lack of a derivative market made risk management difficult. It was a one-way street without short selling. This led to bubbles in equity markets within short durations.

At the peak of the Saudi Arabian equity market in 2005, the market capitalisation was larger than any emerging market. Also, the volatility levels in the GCC equity markets are higher than most emerging markets and significantly higher than developed markets.

Also, there is continued weak economic representation in the equity markets. Even though the region as a whole has been growing at a decent rate of 5.2% in the last seven years, the aggregate market capitalisation of the equity markets dropped by 5.5% in the same period.

On the other hand, the late 2008 bubble in Dubai real estate led investors to take a justifiably cautious stand on the entire regional real estate market. There was a strong reason for ultra-high-net-worth investors to hold a low home bias in this case.

THE CURRENT SCENARIO

Economic growth continues to be strong in the GCC at 6.7% in 2011 and a forecasted 4.2% in 2012. This growth rate is similar in the UAE and Saudi Arabia, the largest market in the GCC, while Qatar’s growth exceeds this rate. Other countries, like Kuwait and Bahrain, have a growth rate band of between 3% and 4% in 2012.

In the past two years there has been a push for reforms in privatisation of public enterprises and more importantly, public-private partnerships. These reforms are already in place in some GCC countries and, in others, at formative stages. The reforms are designed to increase and equip the locally available talent pool and to focus on sectors of importance to society, such as infrastructure, healthcare and education.

These developments in the real sector do not get captured in the secondary markets. However, ultra-high-net-worth investors can tap these segments in private alternative markets. These markets often provide better transparency on investments and give more control over return generation than the public markets. This is owing to an absence of speculative interest in private asset markets and an increased level of management control on the performance of the underlying assets.

This is a global trend. Asset classes such as private equity, hedge funds and real estate have moved from being alternatives to mainstream investments. As per estimates by management consultancy McKinsey & Company, in North America and Europe these alternative asset classes accounted for 12.4% of assets under management in 2009. That figure has roughly doubled.

Local financial institutions have been proactive to address the lack of available investable vehicles. The financial institutions which have a large network base have set up vehicles to efficiently channel investments into public-private partnerships and to ensure a profit-making objective.

Investors, both foreign and domestic, can take part in these investment vehicles which boast internal rates of return in the band of 15-20% over a four to five year period. With the economic turmoil continuing to sweep the developed markets due to low demand creation and global central bankers inducing an artificially low volatility environment in public markets, this asset class is a superior option for regional investors.

ASSET ALLOCATION

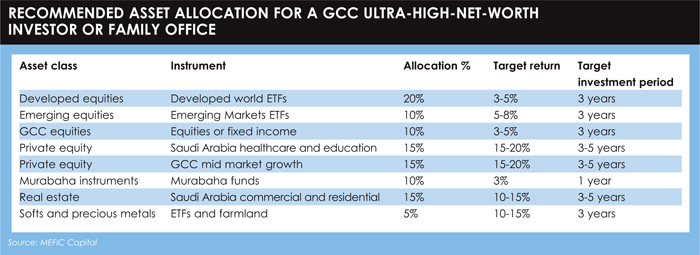

Taking the advantages of the locally available investment options into consideration and also the size of such opportunities, it is time for ultra-high-net-worth investors to re-evaluate their asset allocation. A recommended asset allocation mix for regional clients is to shift from public markets in both developed and emerging markets and increase their allocation to regional alternative asset classes.

Amrith Mukkamala is head of asset management at MEFIC Capital, an asset and wealth management firm based in Riyadh, Saudi Arabia

©2012 funds global mena