Kevin Monserrat, CEO of TokenSphere, explores how blockchain technology is revolutionising asset management, urging fund administrators to adopt it for competitiveness and innovation in a rapidly evolving industry.

In the rapidly advancing world of asset management, blockchain technology is emerging as a game-changer. It sets the stage for a seismic shift in industry dynamics, where traditional roles are blurring, and new strategic battlegrounds emerge. This is not just about embracing innovation; it’s about staying ahead in a competitive landscape where digital transformation is inevitable.

The urgency for innovation in asset management

The asset management industry is at a critical juncture. Entities that were once distinct in their roles are finding themselves in an unprecedented competitive overlap due to the advent of blockchain. The race to own the digital rails and their data is crucial. Traditional lines are blurred, and new alliances and rivalries are forged. In this scenario, adopting blockchain becomes an option and a strategic necessity for Fund Administrators to stay relevant and competitive.

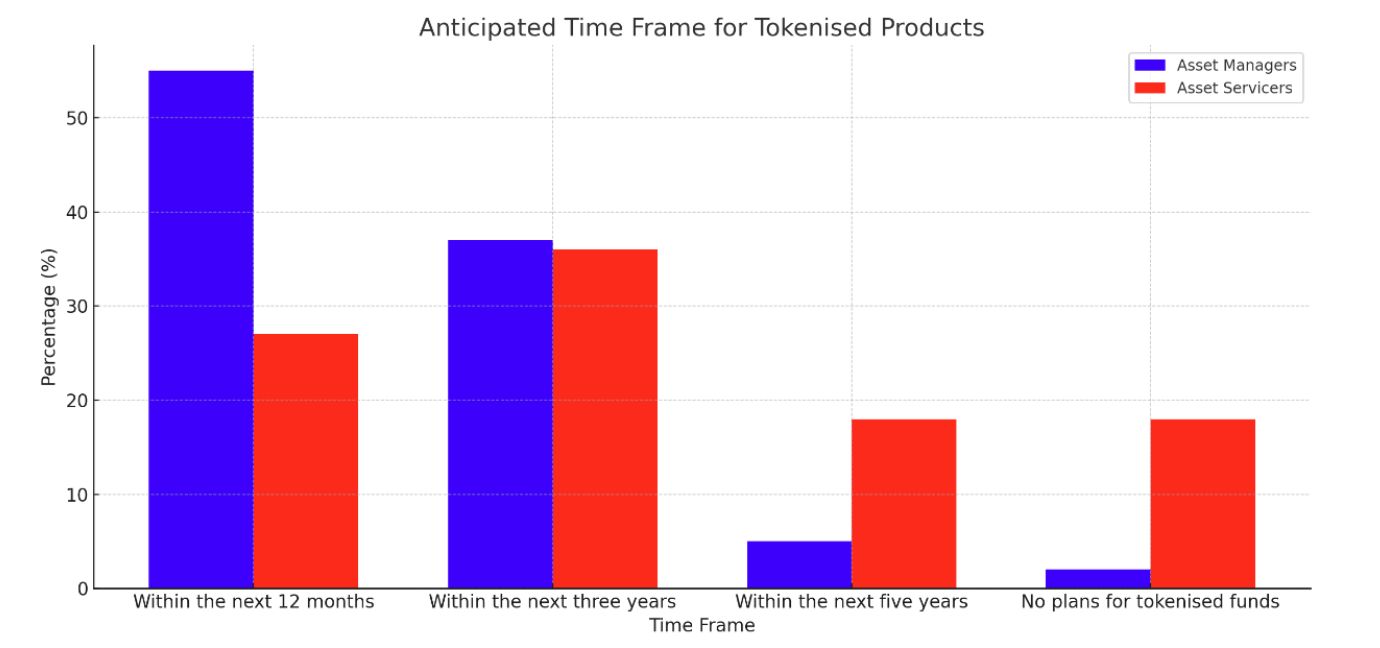

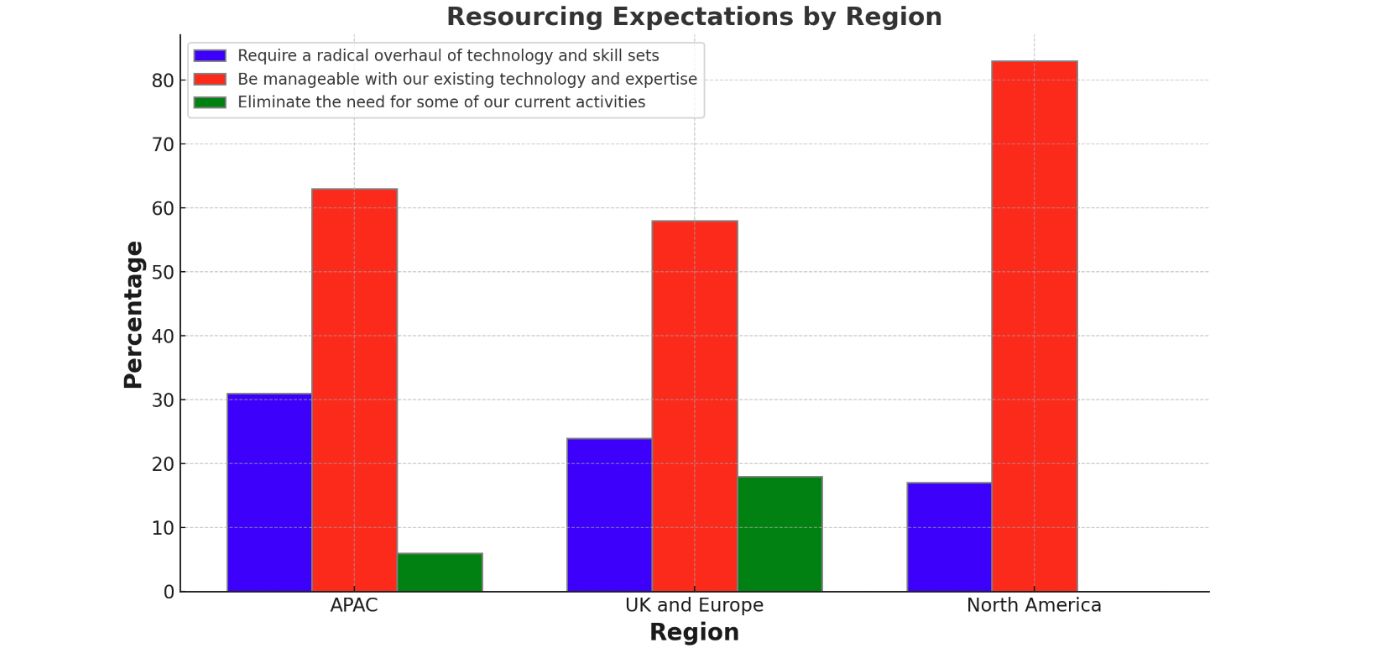

Source: Calastone research report – getting to grips with tokenisation

Data-driven insights and emerging trends

Recent research, such as the study by Calastone, indicates a significant shift towards adopting tokenised vehicles in asset management. Approximately 27% of funds are on the brink of launching tokenised vehicles, with a notable geographical variance in adoption. The USA and the Asia-Pacific regions are leading this innovation wave, while Europe is slowly catching up. This data underscores the growing importance of blockchain technology in the global asset management landscape.

Asset managers as catalysts of change

Interestingly, asset managers are at the forefront of this change, driving a ripple effect across the value chain. This trend compels fund administrators, custodians, and management companies to adapt to new technologies to sustain their revenue streams. Initially apprehensive, these intermediaries now recognise the necessity to evolve or risk losing market share to more agile competitors.

Surprising leaders in blockchain adoption

Contrary to expectations, the large US funds, not the smaller ones, lead the charge in blockchain transformation. While smaller funds may have the desire, they often lack the resources for such a shift. The largest funds, managing over $50 billion, also face challenges due to the scale of change required. The most striking data comes from the mid-range funds ($10 billion to $50 billion in AUM), where over 65% plan to launch tokenised projects within a year.

Source: Calastone research report – getting to grips with tokenisation

Conclusion

The asset management industry is at a tipping point with blockchain technology. The urgency to adopt blockchain is driven by the need to stay competitive, meet evolving customer demands, and capitalise on its efficiency and transparency. The trends and data points discussed signal a clear message: the time for Fund Administrators to embrace blockchain is now. This adoption ensures their continued relevance and positions them as innovators and leaders in the digital transformation of asset management.