Five of the top fund performers in the Mena region in the fourth quarter were Saudi-focused and four of these were sharia compliant, according to data provider Zawya.

Five of the top fund performers in the Mena region in the fourth quarter were Saudi-focused and four of these were sharia compliant, according to data provider Zawya.

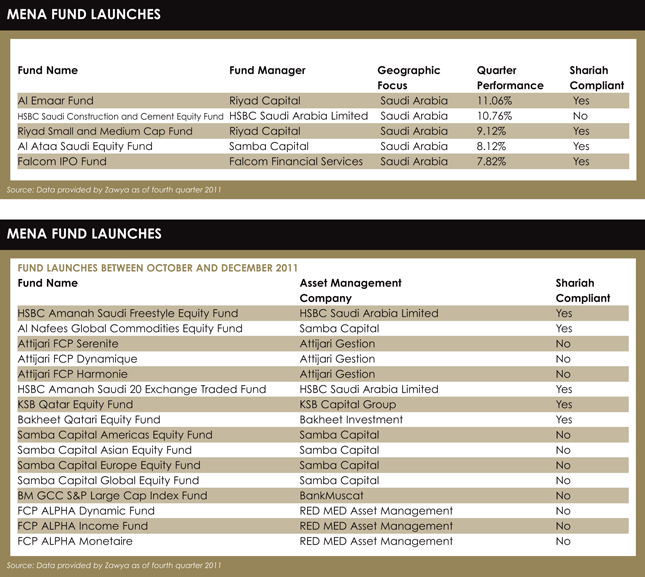

Among all Middle East and North Africa (Mena) funds, the five top performers in the fourth quarter of 2011 were Saudi-focused, with Riyad Capital’s Al Emaar Fund outperforming its peers with an 11.06% return. The third-best performer, Riyad Small and Medium Cap Fund, was also managed by Riyad Capital and made 9.12% in the same period.

In second place came HSBC Saudi Construction and Cement Equity Fund, with 10.76% returns. With 8.12% returns, Samba Capital’s Al Ataa Saudi Equity Fund came in fourth place. The fifth-best performer was Falcom IPO Fund, recording 7.82% returns.

It is noteworthy that four out of the top five performers were shariah compliant. Moreover, four of the top five performers were equity funds, and the remaining one focuses on initial public offerings.

The fourth quarter of 2011 witnessed 16 regional fund launches, of which ten were launched in October 2011. Six of these funds were focused on North African countries, Morocco and Tunisia, five of them were focused on Gulf Cooperation Council countries, and the remaining five were invested worldwide. Three of them were launched by a newly-incorporated asset management company, RED MED Asset Management in Morocco.

Among the asset classes, the equity class witnessed the greatest number of launches as ten equity funds were established in the fourth quarter 2011, one of which was an exchange-traded fund. Three of the launched funds were balanced funds, and only one was a fixed income fund. One index and one money market fund were launched as well. Only five out of the 16 funds created were shariah compliant, all of which were of the equity asset class.

Saudi winners

Among all Mena funds, the five top performers in Q4 2011 were all Saudi-focused, with Riyad Capital’s Al Emaar Fund outperforming its peers with 11.06% Q4 returns. The top third performer, Riyad Small and Medium Cap Fund, was also managed by Riyad Capital and made 9.12% in Q4 2011. In second place came HSBC Saudi Construction and Cement Equity Fund, with 10.76% Q4 returns. With 8.12% Q4 returns, Samba Capital’s Al Ataa Saudi Equity Fund came in fourth place. The top fifth performer was Falcom IPO Fund, recording 7.82% Q4 returns. It is noteworthy that four out of the top five performers were Shariah compliant. Moreover, four out of the top five performers were equity funds, and the remaining one was an IPO fund. The fourth quarter of 2011 witnessed 16 regional fund launches, out of which 10 were launched in October 2011. Six of these funds were focused on North African countries, Morocco and Tunisia, five of them were focused on GCC countries, and the remaining five were invested worldwide. Three of them were launched by a newly incorporated asset management company, RED MED Asset Management in Morocco. Among the asset classes, the equity class witnessed the greatest number of launches as ten equity funds were launched in Q4 2011, one of which was an exchange-traded fund. Three of the launched funds were balanced funds, and only one was a fixed income fund. One index and one money market fund were launched as well. Only five out of the 16 launched funds were Shariah compliant, all of which were of the equity asset class.

Zawya is a business information database for the Middle East and North Africa region

©2012 funds global