Cost-cutting measures in the Gulf countries and political instability in Egypt have weighed on fund managersâ sentiment, writes Gerard Aoun of Thomson Reuters.

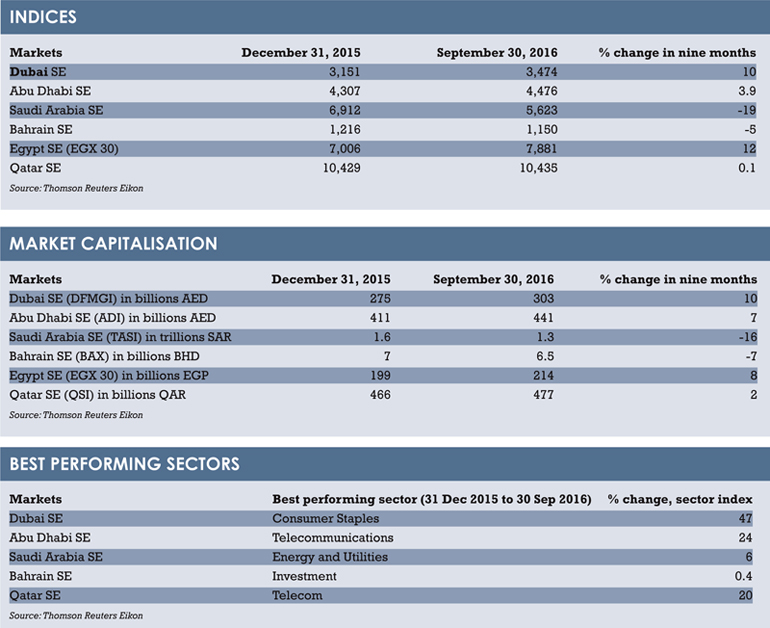

Middle East stock markets exhibited mixed performance figures in the first nine months of the year, with Saudi Arabia’s bourse weighed down by government austerity measures and low oil prices while Egypt’s market was boosted on expectations of more fund inflows.

Regional bourses also took cues from global markets, which stuttered at the start of 2016 due to concerns over China’s economic growth prospects and geopolitical developments such as rising tension between rivals Saudi Arabia and Iran.

Saudi Arabia’s main stock index dropped nearly 19% in the first nine months of 2016. The kingdom, the world’s largest oil exporter, has introduced austerity measures to cope with a large budget deficit after crude oil prices more than halved since 2014.

But the Arab world’s largest market rallied in October after Riyadh issued the largest-ever emerging market bond, selling $17.5 billion of debt, which saw huge demand. In April, the kingdom launched a reform plan, Vision 2030, to ease the country off its dependence on oil exports and lure more investment.

Last month, the Saudi market got another boost when the regulator approved rules for exchange-listed real estate funds to increase investment in the housing sector.

A Reuters survey of 14 Middle East fund managers published at the end of October showed that they had become more positive about Saudi Arabia, with 36% of participants expecting to raise their allocations to Saudi equities over the next three months due to the bond sale, while 14% expect to reduce them. This compares to ratios of between 14% and 29% in a September survey.

However, the survey showed fund managers were losing confidence in Egypt, with only 21% saying they expected to raise equity allocations there and 43% planning to reduce them, compared with 7% and 14% in the previous survey.

Egypt’s stock market had performed well over the nine-month period with the EGX 30 index rising 12.5% by the end of September from the close of December 2015, after the government implemented some economic reforms.

Egypt is struggling with a foreign reserves shortage and is relying on a $12 billion loan from the International Monetary Fund, awaiting approval, to revive its economy, which has been affected by political instability. Under the three-year programme, Egypt must carry out deeper reforms, including currency devaluation and subsidy cuts.

In the Gulf region, bourses have been largely tracking oil prices, corporate earnings and global markets. Dubai and Abu Dhabi’s indices rose 10% and 4% respectively during the first three quarters of the year, while Bahrain’s index slipped 5%.

Investors are expected to remain cautious and are looking at the next meeting in November of the Organisation of the Petroleum Exporting Countries (Opec), to see whether it will result in real moves to cut oil production and shore up crude prices. Opec wants non-Opec producers to participate in any cut to remove excess supply that has kept pressure on prices.

The sharp drop in oil prices since 2014 has impacted several Gulf Arab states, many of which have reduced spending and are planning to introduce new taxes such as value added tax (VAT) to help diversify revenue streams.

During a live chat about the introduction of VAT in the Gulf, Pierre Arman, market development lead for tax and accounting at Thomson Reuters MENA, told the Trading Middle East online forum: “What people should expect is a rate of 5% across all six GCC countries and the likely starting date is 2018.”

He added: “However, a lot of details are left for each country to decide, such as treatment of free zones. That’s why, once the GCC VAT framework is published, each GCC country will have to issue its own VAT legislation in accordance with the overall framework.”

Another Reuters quarterly poll in October showed that analysts are continuing to cut economic growth forecasts for big Gulf Arab economies, suggesting they do not expect an oil price above $50 a barrel to let governments ease austerity policies.

Markets will also be keeping a close watch on the US presidential elections and the Federal Reserve interest rate policy. The Fed kept interest rates unchanged in its last meeting but has since signalled that it could raise rates in December.

Gerard Aoun is the community editor of Thomson Reuters’ Trading Middle East

©2016 funds global mena