Major Gulf markets posted third quarter double-digit gains, while Emaar Malls Group grabbed attention with the largest IPO on UAE markets in five years.

Major Gulf markets posted third quarter double-digit gains, while Emaar Malls Group grabbed attention with the largest IPO on UAE markets in five years.

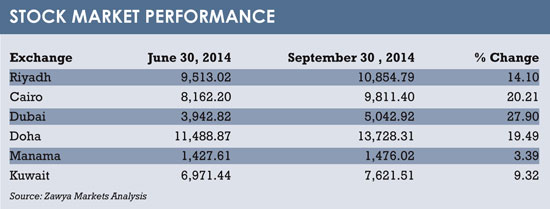

Key regional markets posted double-digit gains in the third quarter on the back of solid corporate earnings and improved business and investor confidence.

Despite the traditional summer lull, investors were buoyed by strong business activity in the first half of the year and hope that the momentum would continue.

Gulf-listed companies saw combined earnings rise 11% during the first half of the year, with banks and financial services, telecoms firms, conglomerates and the real estate sector benefiting from continued fiscal stimulus of governments.

Gulf-listed companies saw combined earnings rise 11% during the first half of the year, with banks and financial services, telecoms firms, conglomerates and the real estate sector benefiting from continued fiscal stimulus of governments.

The Saudi market shot up on news that the country will allow qualified foreign institutions to trade directly in stocks listed on the Tadawul index, while the increased weighting of Qatar in the MSCI Emerging Market Index also helped Doha.

But it was the Dubai market that led the way in the third quarter, rising nearly 28% amid a strong showing of the real estate, retail and banking sectors.

Egypt’s stock market also jumped 20% during the quarter, as the new government announced a string of infrastructure projects aimed at revitalising the economy, which is more politically stable than it has been in the past three years.

The Kuwait and Bahrain markets were also in positive territory, with investors in Kuwait optimistic about improved economic conditions and a ratings upgrade by Fitch Ratings.

FUNDS UPDATE

Several countries introduced new regulations in the third quarter that are expected to improve the investment landscape.

New regulations were announced in the UAE after speculation in May wiped out around $50 billion from Dubai and Abu Dhabi stock markets. UAE regulators vowed to tighten market supervision to ensure orderliness and control.

Saudi Arabia’s plan to open its stock market to foreigners for the first time early next year should allow the Middle East’s biggest economy and most liquid stock market to attract more international investment and perhaps reduce the country’s dependence on oil revenue.

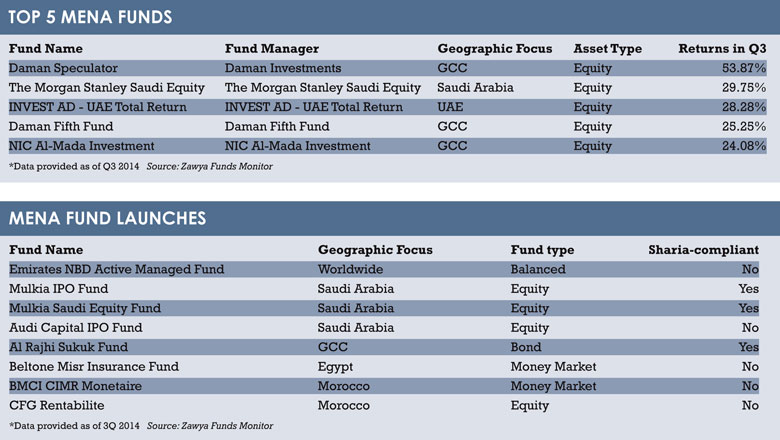

In terms of asset classes, equities led the way in the third quarter – the top five best performers were all equity funds. The market also saw eight fund launches, three of which were sharia compliant. Of the eight, four were equity funds, two were money market funds, one was a bond fund and one was a balanced fund.

IPO UPDATE

Initial public offerings (IPOs) in the third quarter raised $1.7 billion, mainly due to the long awaited initial public offering of Emaar Malls Group, the biggest in the UAE market since 2007, which alone was worth nearly $1.6 billion.

Three other flotations, Zain Bahrain, Al Maha Ceramics and Delice Holding, raised a combined $113 million.

There were 15 rights issues in the third quarter, with ten taking place in Egypt.

©2014 funds global mena