The decision by Vanguard to change its mutual fund benchmarks should lead to more investment in the UAE. But it was also a sign that asset managers want more value from their index providers, finds Nick Fitzpatrick.

The decision by Vanguard to change its mutual fund benchmarks should lead to more investment in the UAE. But it was also a sign that asset managers want more value from their index providers, finds Nick Fitzpatrick.

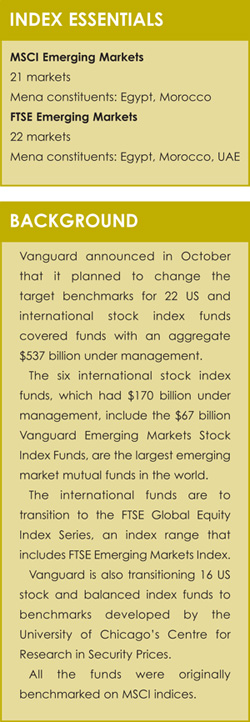

They are split over the status of the UAE; but beyond that issue, MSCI and FTSE, two of the world’s leading index providers, agree about which Middle East and North Africa (Mena) financial markets deserve “emerging” status rather than the less grand title of frontier.

Only two Mena countries make it into the emerging market indices of both providers: Egypt and Morocco. Also, FTSE cites the UAE as an emerging market while MSCI lists it as a frontier.

The importance of an upgrade to emerging market status is measured in capital flows and so the question of whether not only the UAE but also Kuwait and Qatar will be upgraded from frontier markets by MSCI has interested the industry in recent years.

An upgrade should, in theory, unleash more capital inflows as emerging market investors referencing one of the major indices rebalance their portfolios.

But below the level of country upgrades and downgrades, there are the index users – the asset managers and their investors.

Recently, a high profile US-based fund manager with the world’s largest emerging markets stock fund switched from using the MSCI Emerging Markets Index to the FTSE Emerging Market Index – a move that means the UAE should see more inflows over time.

The manager was Vanguard, which had $1.7 trillion of assets under management (at December 31, 2011) making it a top-three US manager by assets and one particularly well known for its index funds business.

CONSIDERABLE SAVINGS

The switch was a sign of asset managers pushing for more value from their index providers and pressing down on costs.

For index providers like FTSE and MSCI that offer indices covering single countries, regions, and the world, it is absolutely in their interest for investors to diversify across international markets and, in doing so, pay licence fees to the providers to reference a range of their indices.

Index providers offer vast numbers of indices designed to bring transparency to investors who want to measure their fund managers, not just in performance but also risk, and the providers are well paid for it.

When making the October 2 announcement that Vanguard would switch to FTSE indices for its emerging market fund, the asset manager said the change was expected to result in “considerable savings” over time for the underlying investors in its funds.

FTSE, which won the Vanguard business, says it is mindful of the cost pressures in the fund management business that arise from fee pressures.

Jonathan Horton, president of FTSE Americas, says: “We are very conscious of costs in the fund management industry. The fees they earn are broadly declining.

“We are also cognisant of charges and costs in relation to our own clients – particularly in the ETF [exchange-traded fund] market place.”

Vanguard is a major provider of ETFs in the US, with a smaller ETF business overseas.

Horton says the relationship between index providers and asset managers is “evolving”. Clients are asking for a broader range of services.

Horton says the relationship between index providers and asset managers is “evolving”. Clients are asking for a broader range of services.

Horton says this has meant demand for index providers to extend benchmarking across asset classes. Recently, FTSE did this to capture foreign exchange movements, for example.

“The reality of what’s happening in the index space globally is that [investors and asset managers] see there is a choice of index providers. Vanguard emphasised that these choices are available.

“What underlines that choice is that we and other index providers produce high quality indices but with differences in approach, and this is important for our clients.”

It is the difference in approach that leads to variations in the lists of index constituents between one index provider and another.

More notable than the UAE is South Korea. This has a larger weighting in the MSCI emerging market index – yet FTSE considers South Korea a developed market.

FTSE promoted the UAE to “secondary emerging” market status in 2010 (FTSE ranks emerging market countries as either secondary or primary), although the decision had been taken in 2009 – the same year that the debt crisis exploded in Dubai, one of the emirates.

PROGRESS AND GROWTH

Part of the criteria for FTSE’s upgrade was the increasing level of liquidity in UAE stock exchanges. It also cited the growing number of large initial public offerings between 2006 and 2008. “The UAE markets were progressing and growing,” says Horton.

But the debt crisis has hit liquidity since then and the number of market makers has dwindled, he notes. The number and sophistication of market makers would be considered by index providers as an infrastructure factor.

A country’s financial infrastructure is important to MSCI and FTSE and Horton says FTSE has engaged with the local stock exchange over the market-maker issue. Legislation with regards to market making are on the UAE agenda.

Index providers would say they encourage and influence countries to adopt better practices and that the rewards are increased capital market investment. When FTSE announced in October 2009 that it would upgrade the UAE, the Dubai Financial Market General Index soared to the highest level in five months.

But Vanguard’s sign suggests asset managers are seeking greater influence with index providers. Horton says the Vanguard switch prompted the phones to ring at FTSE, with interested asset managers on the other end.

©2012 funds global mena