Despite a gradual rise in oil prices, Gulf stock exchanges offered investors few rewards in 2016. Egypt was a notable exception says Gerard Aoun of Thomson Reuters.

Middle East stock markets rose last year, making up for a grim 2015, as oil prices recovered and investor confidence improved. However, geopolitical tensions and economic uncertainties capped gains for some markets.

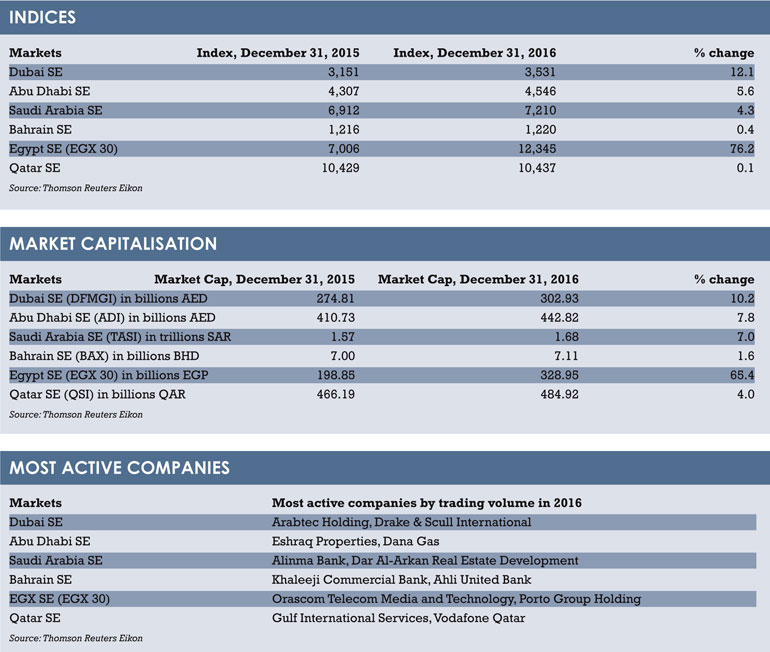

Egypt’s EGX 30 index was the best performer, surging 76% after the government secured a $12 billion International Monetary Fund (IMF) loan and floated the Egyptian pound, weakening the currency and making stock prices more attractive to foreign investors.

Egypt continued its strong trend at the start of 2017 with the EGX 30 hitting a record 13,436 points on January 17 and ending the month up 2.7%. The banking system has attracted inflows of around $9 billion since the central bank floated the currency, a central bank official said at the end of January.

In the oil-exporting Gulf Arab region, stock markets mainly tracked crude prices and global markets in 2016. Many investors opted to remain on the sidelines or move into safe havens such as gold and bonds due to uncertainties around events such as Brexit and the US presidential election.

There could be better news soon. Oil prices firmed up in 2016 after the Organization of the Petroleum Exporting Countries (Opec) reached a deal with non-Opec producers last December to cut output starting January – their first such deal since 2001. Figures released in January 2017 indicate that Opec has delivered more than 90% of pledged output curbs.

SAUDI AUSTERITY

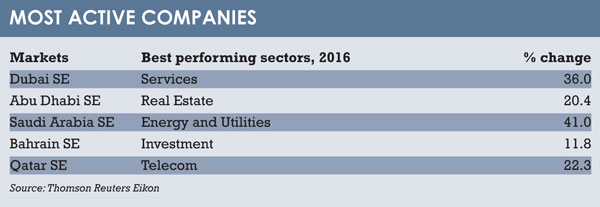

Saudi Arabia, the world’s largest oil exporter and the Arab region’s largest market, saw limited gains in 2016. Its main index rose 4.3% amid concerns that government austerity measures aimed at tackling a record $98 billion budget deficit could stifle the economy.

However, the country has managed to trim its budget deficit and a $17.5 billion sovereign bond issued last October is expected to help the kingdom move ahead with an ambitious economic reform programme. The plan includes selling stakes in state firms such as oil giant Saudi Aramco.

In the UAE, the main Dubai and Abu Dhabi indices rose 12% and 5.6% respectively last year. Dubai registered a 10% increase in market capitalisation, while Abu Dhabi added 7.8%.

According to a Reuters poll of Middle East fund managers released in January 2017, the UAE market remains the top pick, with many fund managers highlighting the country’s diversified economy and attractive stock valuations compared with Gulf peers.

Qatar and Bahrain’s indices were mostly flat for 2016, edging up less than one percentage point each.

TRUMPONOMICS

Looking ahead, investors will be closely watching oil producers’ compliance with output curbs as well as the new US administration’s policies.

Global and emerging markets dipped in January after US president Donald Trump imposed travel bans on citizens of seven Muslim-majority countries within a week of taking office. There is also uncertainty about the potential impact of American protectionist measures on global trade.

Gulf bourses put in mixed performances in January 2017, with Kuwait outperforming peers in a bull run ahead of the government unveiling economic development plans. The index surged 19% last month thanks to increased funds flows from local and regional investors. The surge was partly driven by the anticipation that Pakistan will leave MSCI’s Frontier Markets index in May, thus increasing Kuwait’s weighting.

January also saw the introduction of new regulatory measures in the Gulf, such as the approval of short selling on the Dubai Financial Market and the move to a two-day settlement cycle on the Saudi bourse that may facilitate the country’s inclusion in the MSCI Emerging Markets index.

Saudi Arabia has also introduced the Nomu-Parallel Market, a new equity market with lighter listing requirements than the main exchange, which will offer an alternative platform for company listings.

Gerard Aoun is the community editor of Thomson Reuters’ Trading Middle East

©2017 funds global mena