Middle East markets galloped ahead in the fourth quarter of 2013, with Dubai and Egyptian stock indices posting double-digit gains.

Middle East markets galloped ahead in the fourth quarter of 2013, with Dubai and Egyptian stock indices posting double-digit gains.

The Egyptian stock market built on its gains in the fourth quarter to end the year with a strong showing. The market underperformed its regional peers for much of the year, but investors were encouraged by financial support from the Gulf, which has given Egypt some breathing space in the face of a slowing economy.

Many political questions remain unanswered in the country, but the period of relative stability has attracted investors keen to pick up bargain deals in the Egyptian Stock Exchange index.

Elsewhere, the Dubai index saw a major lift after the emirate won its bid to host the World Expo in 2022. The announcement fuelled an already red hot rally in the emirate, ignited by a strong recovery in the real estate, tourism and services sectors. The Dubai index soared nearly 22% in the fourth quarter, giving it more than a 100% surge for the year.

Other regional markets were more subdued. Some expect crude oil prices to fall in 2014, with Deutsche Bank cutting its forecast by $10 a barrel. The prospect caused many regional investors to cool on Saudi and Kuwaiti markets.

However, most of the Mena region markets enjoyed a stellar year in 2013, with many markets hitting multiple-year highs and pushing through psychological point barriers to erase years of underperformance.

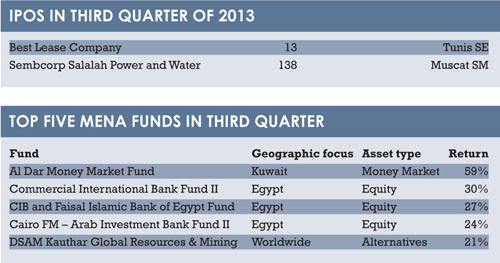

THE IPO MARKET

The fourth quarter showed major signs of improvement in th e initial public offering (IPO) market, with capital of $712 million raised by seven new listings. In contrast, just $151 million was raised in the third quarter.

e initial public offering (IPO) market, with capital of $712 million raised by seven new listings. In contrast, just $151 million was raised in the third quarter.

The biggest listing took place on the London Stock Exchange by Damac Properties, one of three UAE companies to list in London recently. The company raised $348 million through the issuance of 28.39 million global depository receipts (GDRs).

Elsewhere, Tunis has seen much hype with three companies getting listed on the country’s local stock exchange raising a total of $68 million. Two Omani companies, Al Madina Insurance, and the newly formed Takaful Oman Insurance, have generated widespread interest and participation in their listings on the Muscat Securities Market. These firms were the first sharia-compliant, operating and profitable insurance companies in Oman.

The fourth quarter ended with two more companies still undergoing their subscription periods. There was optimism that a number of other companies would seek listings this year.

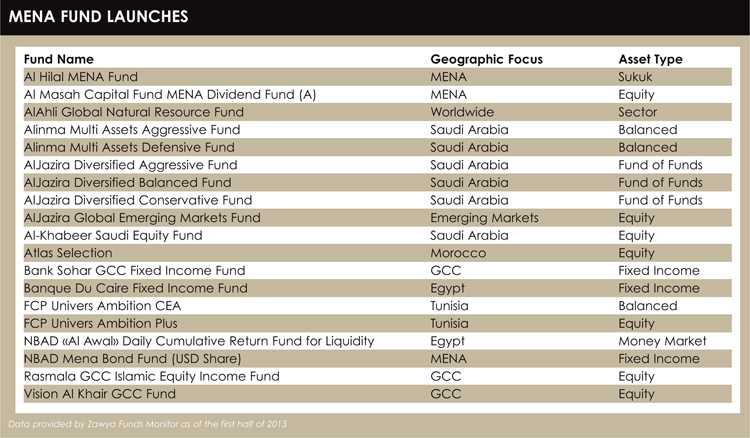

THE FUNDS

It will come as little surprise that funds focusing on the UAE were among the top performers for 2013, according to Zawya Fund Monitor.

Meanwhile, the last quarter of the year saw four new funds launched that invest in fixed income and focus on Morocco.

Overall, Zawya tracked 56 fund launched in 2013, mostly equity funds, among which the majority were focused on the Mena region. Islamic funds had their share of new launches; 17 were sharia-compliant. Despite all the challenges that might face the market, expectations remain high that 2014 will be a good year for funds in the Mena region.

Compiled by the Zawya team of analysts

©2014 funds global mena