An emerging market strategist has advised investors to hold underweight positions in South African equities following a tumultuous week in which the country had three different finance ministers.

An emerging market strategist has advised investors to hold underweight positions in South African equities following a tumultuous week in which the country had three different finance ministers.

The rand fell to a record low against the dollar after President Jacob Zuma sacked Nhanhla Nene, finance minister since 2014, and replaced him with the inexperienced David van Rooyen.

There were also sell-offs in South African equities and bonds in the four days before Zuma performed a u-turn and replaced Rooyen with Pravin Gordhan, who served as finance minister between 2009 and 2014.

Although analysts have generally deemed the return of Gordhan as sensible, some fund managers say the damage to investor sentiment is irreversible.

“Investors have lost confidence and are selling,” says Heinz Ruettimann, strategy research analyst emerging markets at Swiss private bank Julius Baer. “The macroeconomic backdrop is negative and the equity market too expensive. Remain underweight South African equities.”

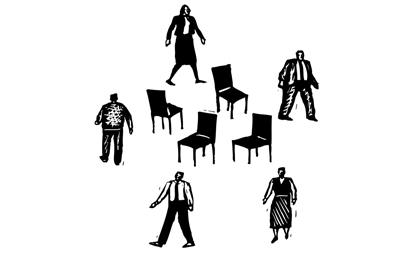

The game of musical chairs at the finance ministry came after ratings agencies downgraded South Africa’s sovereign rating. Economic growth in South Africa is currently running at about 1% with a current account deficit of more than 4%. “Under Zuma’s government South Africa has not taken the necessary steps to reform the country,” says Ruettimann.

©2015 funds global mena